[ad_1]

China’s financial state narrowly escaped a contraction in the next quarter as the fallout from President Xi Jinping’s zero-Covid policy stoked expectations that Beijing would inject hundreds of billions of bucks of stimulus to shore up advancement.

The world’s next-major economic climate expanded .4 per cent calendar year on year in the 3 months to the finish of June, below the 1.2 for each cent forecast by economists, and down from the 4.8 for every cent recorded in the very first quarter.

The slowdown reflected the hit from a two-thirty day period lockdown in Shanghai, which took complete result in April, and illustrated the danger to world progress from Xi’s endeavor to eradicate Covid-19 in the world’s primary production hub.

The National Bureau of Stats figures were being introduced at a tense juncture for Xi’s economic planners. Beijing’s struggle to eradicate coronavirus outbreaks has relied on months of snap lockdowns and significant-handed limitations on mobility, dragging on the speed of China’s financial recovery.

The .4 for each cent final result marked China’s second-worst quarterly progress determine in 30 years, following a contraction at the begin of the pandemic. With to start with-50 % expansion at 2.5 for every cent, Beijing is envisioned to skip its goal of about 5.5 per cent annual advancement for 2022, itself a a few-10 years minimal.

“These info emphasize the unfavourable domestic and external situations that, in tandem with the government’s zero-Covid system, are squeezing economic activity and emphasise the dire need for shorter-term plan measures to revive development,” mentioned Eswar Prasad, economics professor at Cornell College and former head of the IMF’s China division.

He extra that when investment progress experienced held up “better than expected”, it entailed “a slew of medium-time period fiscal and economical risks”.

Adding even more tension on Xi’s administration, youth unemployment rose to a record of 19.3 for every cent.

30-a person Chinese metropolitan areas are less than complete or partial lockdowns, impacting 247.5mn people in locations accounting for about 17.5 for each cent of the country’s economic exercise, according to an investigation introduced this week by Japanese investment bank Nomura.

Xi’s administration has persistently explained it would prioritise preserving the region from coronavirus outbreaks over the economic system. It has blamed the country’s slowdown on the pandemic, the threats of stagflation and financial tightening globally.

Fu Linghui, a spokesperson for the NBS, conceded achieving Beijing’s 5.5 per cent advancement focus on this 12 months would now be “challenging”.

“Generally speaking, with a sequence of insurance policies to solidly stabilise the economy obtaining notable benefits, the national economy has prevail over the adverse effects of unanticipated elements, demonstrating the momentum of a secure recovery,” Fu explained to reporters on Friday.

On a quarter-on-quarter foundation, China’s gross domestic merchandise fell 2.6 for every cent, as opposed with a revised 1.4 for every cent progress in the 1st 3 months of the yr and underneath expectations of a 1.5 for each cent contraction, according to a Reuters poll.

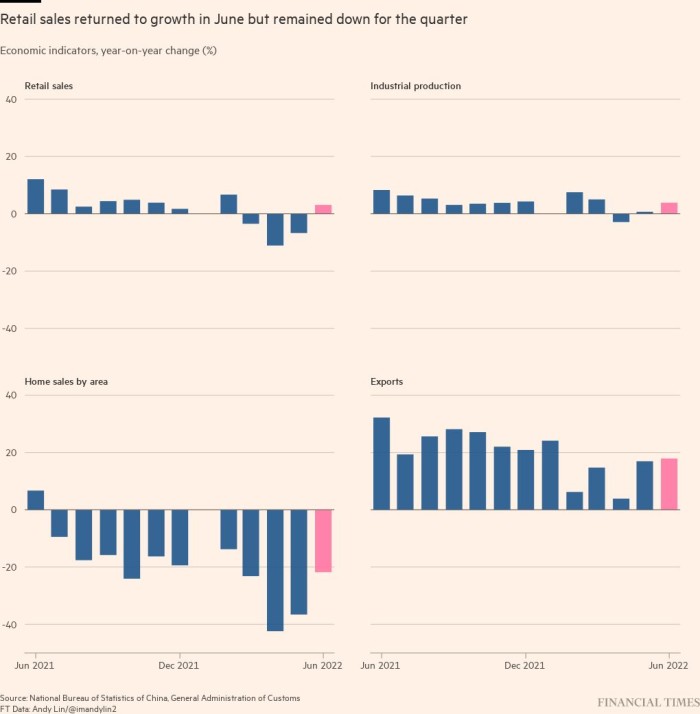

Retail product sales, a important gauge of sentiment in the world’s biggest buyer marketplace, were being down 4.6 for each cent in the second quarter after a double-digit tumble in April. Buyer expending has lagged at the rear of the wider restoration due to the fact the commence of the pandemic, in element mainly because of travel constraints.

Industrial output was up 3.9 per cent in June compared with the same time period a 12 months previously. Manufacturing unit output was up .7 for each cent for the 2nd quarter.

Julian Evans-Pritchard, a senior China economist with Capital Economics, mentioned the three-thirty day period effectiveness “was even weaker than fulfills the eye” irrespective of advancements in June.

“The figures bureau promises that output in the next quarter was marginally bigger than a 12 months back,” he explained. “That’s implausible even accounting for the robust rebound shown on the month to month information for June . . . This isn’t the very first time that the official GDP figures have seemingly understated the extent of an economic downturn.”

Mounted asset investment, China’s major measure of capital shelling out, grew 5.6 for every cent past month. Infrastructure expenditure was 7.1 for every cent higher as Beijing enhanced its stimulus attempts, whilst authentic estate financial commitment dropped 5.4 for every cent.

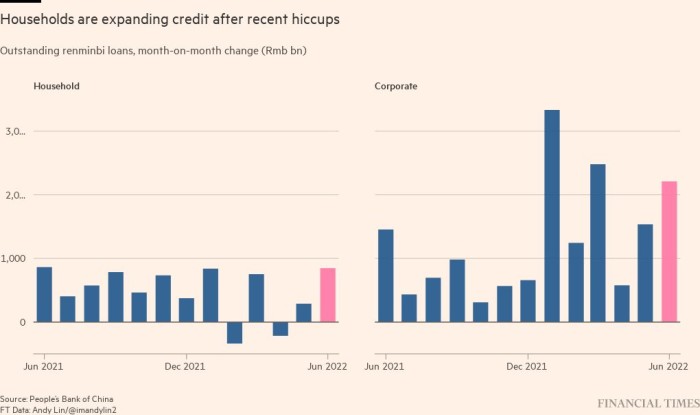

China’s deeper financial slowdown could prompt looser financial coverage and fiscal stimulus, stated analysts, in contrast to made economies that are increasing interest rates to deal with high inflation.

But a new section of credit score-fuelled investment decision pitfalls undercutting makes an attempt to deal with high leverage and undesirable debts in the house sector, which have raised anxieties above monetary steadiness. The People’s Lender of China has been unwilling to reduce fascination fees for worry of funds outflows.

In spite of criticism that the central government is reverting to financial debt-fuelled and wasteful investing — substantially of it specific at large-scale infrastructure, and funded via neighborhood governments — Beijing is significantly determined to stem the financial slowdown and rising unemployment.

The Money Instances described this 7 days that neighborhood governments across China would be allowed to problem an added Rmb1.5tn ($223bn) worthy of of bonds this year to increase flagging progress. The expending would be introduced ahead from upcoming year’s quota.

Prasad, even so, stated “the area for manoeuvre” for financial policy easing by the People’s Lender of China was narrowing simply because of mounting US interest premiums. He also observed challenges posed by a “currency-depreciation funds outflow spiral that could be triggered by any broad and intense easing of financial policy”.

Additional reporting by Tom Mitchell in Singapore and Jennifer Creery and Andy Lin in Hong Kong

[ad_2]

Source connection

More Stories

How to Evaluate a Franchise – 4 Key Points to Consider!

21 Secrets to Franchise Business Success

The Advantages of a Franchise